A canceled subscription continues to bill because the subscription cancel date is after the next scheduled bill run. In such cases, you can issue a credit memo and apply the memo to the invoice to reduce the invoice amount. Specify how credit memos are automatically applied during payment runs.

It can be most common in many business-to-business transactions. Both a debit memo and a credit memo inform clients of a change in their account status. Customers are informed by a debit memo as to why their account balance has decreased or why they now owe more.

Payments made through Memo Manager should then be closed with a note indicating the reasons for the memo’s closure. Include a timeline on the pre-notification memo so agent is meeting the carrier’s deadline to respond to the credit card company. The airline should not issue a debit memo to agent until the deadline noted on the pre-notification has passed. Provide fare rule training, including refund and exchange processes, to agents in order to avoid errors and subsequent debit memos. This memo is a legal document that informs the customer of a debit adjustment made to their accounts.

Air Canada manages inventory, on an Origin and Destination (O&D) basis commencement logic. As a result, inventory that is available on a particular segment for one O&D, may not be available for another O&D, even though both O&Ds include the same segment as part of the itinerary. Also, the same O&D could not be available in case of another POC for another customer journey.

Debit Memo Policy for Travel Agents

In this situation, a debit note will be issued for the value of the damaged or returned goods. A debit memo, also known as a debit memorandum, can be defined differently in different situations. In the case of an organization, it is issued for rectifying an under-billed transaction.

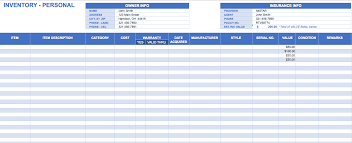

Create credit and debit memos either from invoices or from one-time charges. Rather than generating negative invoices, the bill run creates credit memos populated by any negative charge event resulting from the charge rating process. Directly creating credit memos in this case makes it easier to manage negative charges and balances for Accounts Receivable settlement purposes. By applying one or more credit memos to invoices with positive balances, you can reduce the invoice balances in the same way that applying a payment to an invoice. In banking, fees are automatically taken out of an account and the debit memorandum is noted on its bank statement. Common debit memos include returned check fees, insufficient funds fees, interest fees, fees for printing checks, bank equipment rental fees, and adjustments to incorrect deposits.

Credit or debit card for kids: Which is best? – WGHP FOX8 Greensboro

Credit or debit card for kids: Which is best?.

Posted: Sun, 12 Mar 2023 08:00:00 GMT [source]

The bank’s use of the term debit memo is logical because the company’s bank account is a liability in the bank’s general ledger. The bank’s liability is reduced when the bank charges the company’s account for a bank fee. Hence, the credit balance in the bank’s liability account is reduced by a debit. Within a firm, a debit memo can be created to offset a credit balance that exists in a customer account. If a customer pays more than an invoiced amount, intentionally or not, the firm can choose to issue a debit memo to offset the credit to eliminate the positive balance.

Debit Memos in Incremental Billings

Any incorrect RBD which are in-corresponding with applicable fares and conditions, on Thai Airways International Public Company Limited and on other airlines shown on either PNR creation or ticket document. An ADM shall be processed through the BSP Link if issued within nine months of the final travel date and/or the expiry date of the document if the final travel date cannot be identified. Only Credit Memos that have status Open can be applied to outstanding invoices.

African fintechs halt virtual dollar cards after Union54 chargeback fraud surge – TechCrunch

African fintechs halt virtual dollar cards after Union54 chargeback fraud surge.

Posted: Mon, 18 Jul 2022 07:00:00 GMT [source]

Freelance project workers often realize they’ve undercharged their services when compared with the amount of time and energy expended. In such a case, the service provider will have to make a billing adjustment. After reversing a receipt, create a debit memo reversal to note the net amount of a completed debit and credit transaction. Add late fees to a client’s account or customer site.

Debit memos can also be used in invoicing, such as when debt that was previously written off is recovered. A debit memo in that case replaces the original invoice. In case of rebookingbeforethe train ticket is collected, new pick up number will be generated. Passenger is expected to get the new pick up number from the airline handling agent. Agents with BSPlink access may dispute an ADM via their BSPlink dispute facility within the ADM dispute period. Ethiopian Airlines will endeavor to handle a rejected or disputed ADM in a timely manner.

Invoice, Credit or Debit Memo

The Agent can dispute an ADM issued by Thai Airways International Public Company Limited through BSP Link for maximum period of 15 days following the default action taken in accordance with IATA Resolution 850m. Promotions.In case of promotions there may be a need to decrease a subscription’s price. A new Credit Memo can be issued for a delta with the details above. All disputes must clearly indicate the dispute amount, reason for dispute, and must include supporting documentation.

If there is a small credit balance remaining in a customer account, a debit memo can be generated to offset it, which allows the accounting staff to clear out the balance in the account. This situation can arise when a customer overpays , or when an accounting error leaves a residual balance in an account. There are several uses of the term debit memo, which involve incremental billings, internal offsets, and bank transactions.

The good news is we put together this guide to cover the most important pieces of information. Due to technical reasons the journey times stated in your booking are fictitious. Please go to check the times of train connections on the actual travel date. Ethiopian Airlines will only include more than one transaction on any ADM if the reason for the charge is the same and will provide details with the ADM.

When an original invoice is sent with an amount that was too low, a debit memo may be sent with the incremental correction. This method is not commonly used because most companies reissue an invoice with the corrected amount instead. Debit memorandums are also used in double-entry accounting to indicate an adjustment that increases a customer’s amount due. To request a reduction in the amount owed to a seller, such as when returning faulty goods, the buyer issues a debit memo and debits Accounts Payable. So how exactly do debit memos work and what do you need to know?

If Ethiopian Airlines reject the dispute an explanation for the rejection will be sent to the Agent. It is Ethiopian Airlines policy to mandate the use of electronic tickets “e-tickets” on routes where e-tickets are available. Where a paper ticket is issued for an e-ticketable journey, Ethiopian Airlines may impose a charge that will be collected by ADM. When fully or partially closing a memo, provide an explanation of why the debit memo is being closed. Close memos in Memo Manager within 14 calendar days of receiving payment.

credit card statistics are not in decline – Retail Banker International

credit card statistics are not in decline.

Posted: Wed, 11 Jan 2023 08:00:00 GMT [source]

Sets up transaction tax content including regime to rate configuration, rules, tax determinants, configuration options and party tax profiles. Manages intrastat transactions including collecting, validating, exporting, printing, and purging intrastat transactions. Defines intrastat country characteristics, parameters, and rules.

- You can create a debit memo to reflect a charge for an item that isn’t a typical invoice item.

- Cindy works for Fluffy Stuffs Inc., a toy company specializing in the manufacture of stuffed animals.

- These can be common with many types of bank transactions.

- Apply credit memos to invoices and debit memos to settle outstanding balances.

Special instructions information appears on the printed https://1investing.in/ memo document. Debit notes can be issued both from a buyer or a service provider. Refund a certain amount of the credit memo balance to your customer. Many larger companies adopt the procedure of raising a debit note for any errors on invoices.

- For example, if a customer ordered and paid for $1,000 in lumber in April, and the cost of lumber when it was delivered in June increased to $1,150, a debit memo could be issued for the $150 extra cost of lumber.

- You confirm that the refund payment to customer was successful.

- This would expedite the exchange of passenger tickets .

- A debit memo on a company’s bank statement refers to a deduction by the bank from the company’s bank account.

Preview what is bookkeeping memos in billing previews, bill run previews, subscription previews, or amendment previews through the REST API. Debit memos are often used in accounting to rectify overpayments from customers. A debit note is a commercial seller’s, buyer’s, or financial institution’s notification of a debit placed on a recipient’s account in the sender’s books. It gets created and then sent off to a supplier that also includes a note that explains what it’s for. To record the net amount of a successful debit and credit transaction, you can create a debit memo reversal.